Menu

Contact Us: 416.615.1555 | sale@booksvendingmachine.com

Menu

Contact Us: 416.615.1555 | sale@booksvendingmachine.com

Choosing the right payment machines is crucial for any business today. In a recent report by Statista, nearly 80% of consumers prefer card payments over cash. This shift highlights the importance of having the right payment solutions. Companies often underestimate the impact of payment machines on customer experience.

The variety of payment machines can be overwhelming. Businesses need to assess their specific requirements. Factors include transaction volume, types of accepted payments, and integration with existing systems. Studies show that 50% of customers abandon their purchases due to slow payment processes. Investing in efficient payment machines can eliminate these frustrations.

Moreover, maintaining updated technology is vital. Businesses that fail to adapt may lose competitive advantage. Data indicates that 68% of customers are more likely to return to a business that offers seamless payment options. Reflecting on these realities can help businesses make better choices regarding payment machines. They must prioritize functionality alongside customer convenience.

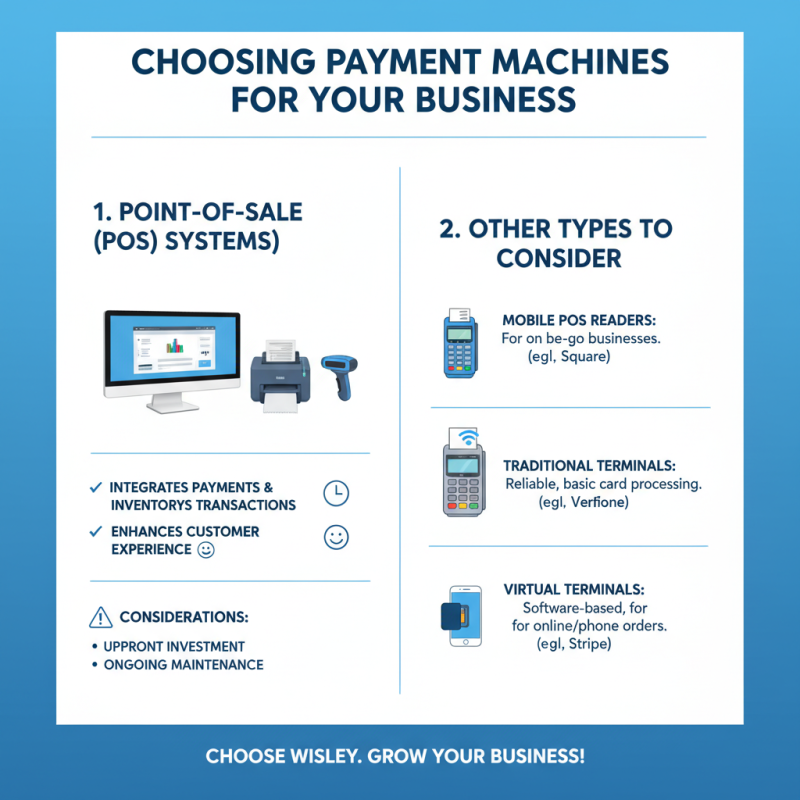

When selecting payment machines for your business, it’s essential to understand the various types available. Point-of-sale (POS) systems are popular. They integrate payment processing with inventory management. These systems can streamline transactions and enhance customer experience. However, they may require upfront investment and ongoing maintenance.

Mobile payment solutions are another option. They allow businesses to accept payments on the go. A smartphone or tablet can be used with a card reader. This flexibility can attract more customers. But, network issues may interrupt service, leading to frustration.

Tips: Consider transaction fees carefully. They can add up and affect your bottom line. Also, think about customer support. Reliable assistance is crucial during busy hours. Security features are vital too. Check if the machine offers encryption and fraud protection.

Every option has its pros and cons. Some businesses may overlook hidden costs. A machine that seems affordable could become expensive over time. Assess your business needs and customer preferences. The right payment machine should enhance operations, not complicate them.

When selecting the right payment machines, understanding your business needs is crucial. Evaluate your transaction volume closely. A study by the National Retail Federation noted that a business handling over 1,000 transactions monthly may benefit from advanced machines. Payment processing fees can eat into profits, so choose wisely.

Tip: Analyze your current transaction methods. Are they efficient? Efficient methods usually enhance customer satisfaction and streamline operations. If your store is busy during peak hours, opt for machines that handle transactions quickly.

Consider your future growth. If you're expanding, think about machines compatible with different payment types. Research shows that 70% of consumers prefer contactless payments. If your transactions are low, more basic models may suffice. Yet, make sure they can grow with your business needs.

Tip: Talk to your team. Their insights can highlight gaps in your current system. Understanding how many transactions you handle daily can guide your choice significantly. It’s a balancing act. Look for flexibility in your choices to avoid future regrets.

When selecting a payment machine for your business, consider the costs and fees involved. Each payment processor has different charging structures. Some charge a flat rate per transaction, while others take a percentage of the sale. Break down these costs to understand your potential expenses better. Small businesses might prefer machines with lower upfront costs, but beware of hidden fees that can add up over time.

Examine the transaction fees closely. A lower rate might seem appealing, but additional costs can emerge. Monthly fees, maintenance costs, and even service charges can impact your bottom line. Remember, the cheapest option isn't always the best fit for your business. Not all payment machines provide the same value. Some may lack essential features, such as reporting tools or customer support.

Don’t overlook compatibility with your existing systems. A machine that works smoothly with your software can save you time and frustration. Reflect on your business model, too. Seasonal fluctuations or high-volume sales might require a different setup. It’s vital to consider how each option aligns with your operational needs and long-term goals. Evaluate your choices carefully. Sometimes taking a risk can lead to better opportunities.

When selecting payment machines, security features are crucial. These machines handle sensitive customer information, including credit card details. Look for devices that support encryption technology. This helps protect data during transactions. Additionally, check for compliance with industry standards. Standards like PCI DSS are essential for any business handling payment data.

Consider the machine's ability to detect fraudulent transactions. Some payment systems offer real-time monitoring. This could mitigate risks early, reducing potential losses. Also, assess their update policies. Machines must receive regular updates to defend against evolving threats. An outdated machine can leave your business vulnerable.

Reflect on user experience as it relates to security. Training staff on best practices is vital. A machine that operates smoothly but lacks security features could lead to serious problems. Evaluate customer feedback about the payment process as well. Understanding customer sentiments can reveal hidden security concerns. Security shouldn’t just be a checkbox; it needs in-depth consideration.

When selecting payment machines for your business, customer support is crucial. A reliable support system ensures that you receive help when issues arise. Issues can happen anytime, so having access to knowledgeable support can save you time and money. Evaluate the support options before making a decision.

Tips: Look for24/7 support availability. Ensure they offer multiple communication channels. This includes phone, email, and live chat. You want quick responses in urgent situations.

Consider the technical assistance offered. Some machines require more extensive setup. Support can vary in quality and responsiveness. A company with good tech support can help troubleshoot problems effectively. Test their response time before committing.

Tips: Request a demo or trial period. This way, you can assess their support firsthand. Take notes on your experience, and reflect on the effectiveness of the assistance received. Sometimes, businesses overlook these details until issues become apparent.

| Payment Machine Type | Customer Support Options | Technical Assistance Availability | Response Time | User Ratings |

|---|---|---|---|---|

| Mobile Payment Terminals | 24/7 phone support, online chat | On-site and remote support | Within 1 hour | 4.5/5.0 |

| Point of Sale Systems | Email support, live training | Remote support available | Within 2 hours | 4.2/5.0 |

| Self-Service Kiosks | In-app support, troubleshooting guides | Remote diagnostics | Within 3 hours | 4.0/5.0 |

| Virtual Payment Gateways | Email support, extensive FAQs | Webinars and online resources | Within 4 hours | 4.3/5.0 |